owngarden/E+ via Getty Images

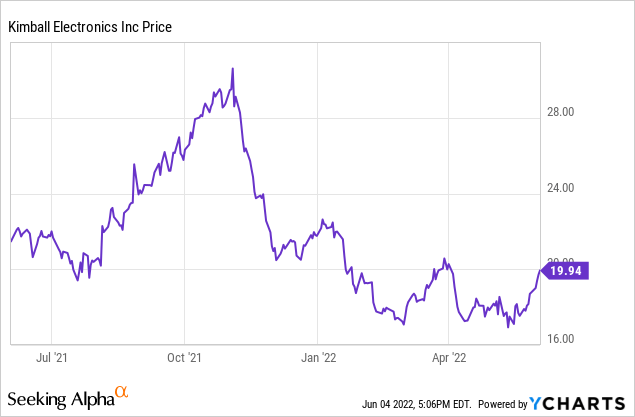

As a provider of global manufacturing solutions, Kimball Electronics (NASDAQ:KE) is ideally positioned to capitalize on megatrends in the vertical markets of automotive, medical, and industrial. This positioning will contribute to profitable growth to $2 billion in annual revenue within the next few years. We believe this growth is not appreciated by the market and the company is undervalued. We are initiating coverage with a BUY rating and a $25 price target.

Investment Thesis

- The company recently reported record quarterly sales, and the momentum should continue as macroeconomic headwinds dissipate.

- KE supports applications in the automotive vertical market, where electronic content is being added to vehicles at an increasing rate.

- The company’s medical vertical represents a significant growth opportunity as the population ages and medical devices become more advanced.

- The industrial vertical is expected to grow, driven by an increasing need for conservation of water, gas, and electricity.

- We believe KE’s shares are undervalued, trading at 8.6 times our FY23 estimate of $2.12. Our target price is based on an industry average P/E ratio, blended with our DCF model.

Primary Risks

- Macroeconomic headwinds such as COVID-19, the Ukraine war, supply chain issues, and inflation in the United States may continue longer than expected.

- The company has a significant reliance on the automotive and medical verticals. A decline in these industries could adversely affect revenue and profitability.

Investment Thesis

Kimball Electronics was founded in 1961 and incorporated in 1998. The company is a global manufacturing solutions provider of contract electronics and diversified manufacturing services, including engineering and supply chain support, to customers in the automotive, medical, industrial, and public safety markets. KE has been producing critical electronics components and assemblies for automotive customers for over 35 years. Over time, the company’s expertise in producing these products has expanded to include the medical, industrial, and public safety vertical markets.

Kimball Electronics is frequently a single-source supplier for manufacturing applications with the most exact, stringent, mission-critical, high-reliability, high-quality, “has-to-be-right” product specifications. A slide from the company’s overview which demonstrates their “end-to-end partnership solutions” is in the below picture.

Kimball Electronics and Singular Research

Many of Kimball Electronics’ customers are multinational companies, and KE has a global footprint to support their needs. The company is headquartered in Jasper, Indiana, and has manufacturing facilities in the United States, Mexico, Poland, Thailand, Romania, Vietnam, and China.

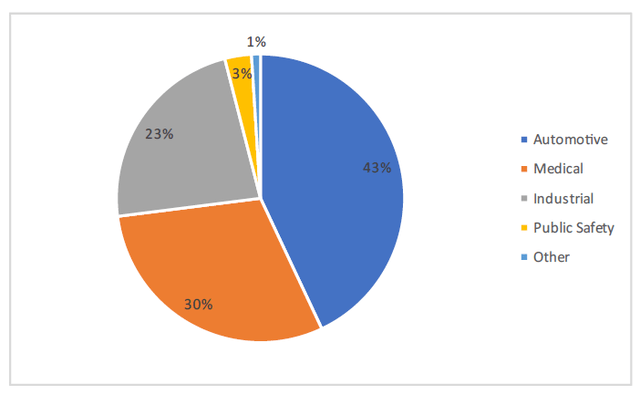

KE has a diversified portfolio serving several large clients in each of its vertical market. A breakdown of net sales in FY21 by vertical is shown below.

Kimball Electronics and Singular Research

Within the automotive market, Kimball Electronics is a Tier 2 supplier, providing its customers (Tier 1 suppliers) products needed in electronic power steering, body controls, automated driver assistance, and electronic braking systems. In the medical market, Kimball supports assemblies for sleep therapy and respiratory care, image-guided therapy, in-vitro diagnostics, drug delivery, AED, and patient monitoring. Industrial includes applications for climate controls, circulating pumps, automation controls, optical inspection, and smart metering, while in the public safety market, the company focuses on thermal imaging, first-responder electronics, and security.

Our thesis is that Kimball Electronics is ideally positioned for profitable growth, not appreciated by the market, and that the company is undervalued at current levels. We believe KE will deliver outsized returns for shareholders primarily due to the following:

- KE is well positioned for the growth. Its most recent quarter produced record sales, during a period with significant macro headwinds. As these headwinds dissipate, growth will likely accelerate.

- Kimball Electronics will benefit from megatrends in the automotive vertical market as electronic content is increasingly being added to vehicles through advanced technologies and expanded operating systems. This trend represents a meaningful organic growth opportunity for the company.

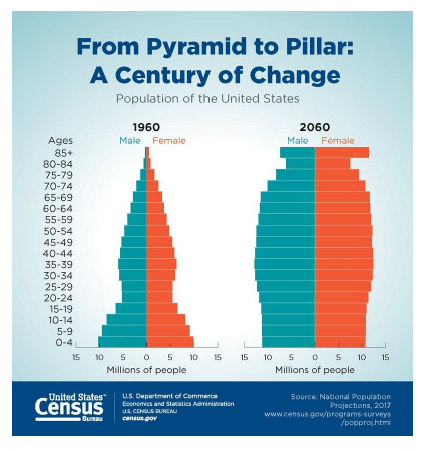

- Megatrends in the medical vertical market also represent excellent growth potential as a result of the aging population, increasing access and affordability to healthcare, decreasing medical device sizes, and connected drug delivery systems. In addition, the company has recently launched Kimball Medical Solutions to focus on this vertical market.

- Kimball produces products for the industrial vertical that will drive growth as the cons

ervation of water, gas, and electricity increases in popularity. - KE is undervalued and trades at 8.6 times our FY23 EPS estimate of $2.12. Our price target is based on the competitors’ average 11.92 times our FY23 earnings forecast blended with our DCF model price.

We initiate coverage with a BUY rating and a $25 price target.

Kimball Electronics Had Record Sales – Momentum Should Continue

The company’s most recent quarter produced record sales, despite significant macroeconomic headwinds. All four verticals showed sales growth in the quarter year-over-year. Sales in the automotive vertical was $162 million, up 16% and an all-time high; sales in medical increased 20% at $103 million; sales in industrial grew 22% at $84 million; sales in public safety was up 2% at $13.8 million. This growth is impressive considering the highly publicized macroeconomic issues confronting the world. Russia and Ukraine play a significant role in the automobile industry (this vertical represented 44% of KE’s total revenue during Q322). Russia is a large exporter of commodities and is a major supplier of palladium, platinum, nickel, and aluminum. Palladium and platinum are key raw materials for catalytic convertors, nickel is used in EV batteries, and aluminum and copper are needed for vehicle framing and wiring. In addition, China’s zero tolerance policy related to COVID-19 is temporarily impacting sales, and inflation is driving costs up. As these headwinds dissipate, the company is well positioned with a record level of backlog at $930 million and strong demand for its products.

Kimball Is Ideally Positioned To Capitalize On The Megatrends In The Automotive Vertical

Kimball Electronics supports exciting and growing areas of the automotive market resulting in excellent growth potential for the company. Megatrends in the auto industry should be a tailwind for KE, with more electronic componentry being added to vehicles with high-tech operating systems. Kimball Electronics provides components to Tier 1 suppliers for electronic power steering, body controls, automated driver assistance, and electronic braking systems. Because of these products, KE could benefit from the growing popularity of fully electric vehicles and autonomous driving features.

According to a January 2022 self-driving cars market report by ResearchandMarkets, the self-driving market is expected to grow from 20.3 million units as of 2021 to 62.4 million units by 2030 at a CAGR of 13.3%. Vantage market research estimates the global electric car market is expected to grow to $354.8 billion from $105 billion in 2021 at a CAGR of 19%. The growth in these two markets along with the desire for automobiles to have higher tech operating systems will provide significant upside to Kimball Electronics going forward.

Megatrends In The Medical Vertical Market Also Provide Growth Opportunities As The Population Ages And Medical Devices And Drug Delivery Systems Are Improved With New Technologies

Kimball Electronics’ products in the medical vertical include sleep therapy and respiratory care, image guided therapy, in vitro diagnostics, drug delivery, AED, and patient monitoring. These types of products should grow as the population ages. As shown in the below exhibit, according to National Population Projections, by 2030, baby boomers will be older than age 65. One in every five people in the U.S. will be retirement age, and older people are projected to outnumber children for the first time in U.S. history (U.S. Census Bureau). The demographics along with technological advances such as decreases in device sizes and connected drug delivery will provide support to Kimball Electronics in their medical vertical.

National Population Projections, United States Census Bureau, 2017

The Industrial Vertical Provides Opportunities As Conservation Of Water, Gas, And Electricity Increases In Popularity

Kimball Electronics focuses on products that include climate controls, automation controls, optical inspection, and smart metering. Since these products help with the conservation of water, gas, and electricity, we believe Kimball will benefit greatly as the conservation trend grows. The industrial vertical saw an increase in sales of 22% during fiscal Q322. This growth was driven by high-end market demand for climate control products as well as new customer additions.

The Leadership Team

Donald D. Charron has been CEO and Chairman since 2014. Prior to 2014, he served as an Executive Vice President of Kimball International, Inc. (their former parent company), a member of the Board of Directors of Kimball International, and the President of Kimball Electronics Group. He led the EMS segment of Kimball International since joining the company in 1999. Prior to his time at Kimball, he spent six years at Rockwell International in various leadership roles. He earned his B.S. in electrical engineering from the South Dakota School of Mines and Technology in 1987.

Jana Croom was appointed Chief Financial Officer effective July 1, 2021. She joined Kimball Electronics in January 2021 in the role of Vice President, Finance. Prior to KE, she held the position of Vice President, Financial Planning and Analysis for NiSource, one of the largest fully regulated utility companies in the United States, since August 2019. From 2010 through 2019, Ms. Croom held positions at NiSource including director roles in operations planning, state finance, and regulatory affairs. She has more than 20 years of experience in various areas of finance, is a graduate of the College of Wooster, and earned a Master’s degree in Business Administration from the Fisher College of Business at The Ohio State University.

Q322 Financial Results

KE’s fiscal third quarter sales exceeded its all-time high in a quarter by 10%. Net sales increased 19% to $368.1 million, compared with sales in Q321 of $310.3 million. Net income rose 30% to $13.6 million or $0.54 per diluted share compared to $10.5 million or $0.41 per share in Q321. Operating income was 5.5% of net sales which was an 80-basis point improvement compared to Q321. The company also purchased $4.9 million of stock during the quarter.

All four verticals showed sales growth in the quarter year-over-year. Sales in the automotive vertical was $162 million, up 16% and an all-time high; sales in medical increased 20% at $103 million; sales in industrials grew 22% at $84 million; sales in public safety was up

2% at $13.8 million.

EPS Guidance And Estimates

Management provided guidance for Q422 and FY22. They expect Q422 sales of $370-$390 million and operating margin to be above 5%. Management expects FY22 sales to be in the $1.345-1.365 billion range, a 4-6% increase year-over-year. This guidance is down from $1.4 billion. Mr. Charron commented that in China, “there may be temporary disruptions in both the supply chain and demand as our customers balance manufacturing delays.” As a result, KE updated guidance to reflect this uncertainty.

Demand remains strong. The company has an open order backlog of $930 million which is a record high and is up 43% year-over-year which is driven by new business wins and component shortages.

For Q422, we expect sales to be up 15% to $378 million and EPS to be $0.57. For FY22, we expect sales to be up 4.9% to $1,354.5 million from $1,291.8 million in FY21. In FY23, we forecast sales to rise by 6.0% to $1,436.0 million.

For FY22 and FY23, we forecast net income of $35.6 million and $53.5 million, respectively. These forecasts result in diluted net earnings per share in 2022 and 2023 of $1.41 and $2.12, respectively.

Investment Risks

Macroeconomic headwinds which have impacted the company’s sales and profitability could continue longer than expected. Kimball Electronics has significant exposure to similar headwinds that many companies are facing today. KE has facilities near Ukraine in Poland and Romania, where associates are actively involved in refugee support efforts. It also is impacted by the supply chain issues relating to car manufacturing as Russia is a large exporter of commodities used in manufacturing cars. In the United States, the company is also impacted by the inflationary environment. Management expects to continue to be impacted by the zero-tolerance policy related to COVID-19 in China and, as a result, has lowered expectations for the next quarter. If these shutdowns last longer than expected, results would be negatively impacted going forward.

Kimball Electronics has a significant reliance on a few industries. 99% of sales in the third quarter came from four industries – Automotive (44%), Medical (28%), Industrial (23%), and Public Safety (4%). Any impact to these industries could adversely impact KE’s results.

Valuation

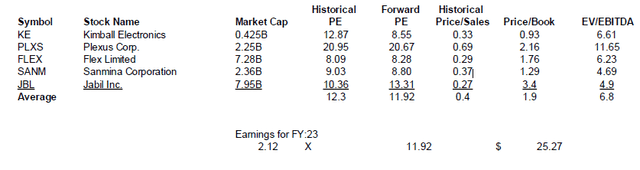

Kimball Electronics trades at 8.6 times our FY23 EPS estimate of $2.12. As shown in Exhibit 6, this forward P/E ratio is significantly lower than KE’s average competitor. We value KE using a blended valuation methodology where we blend 50% of KE’s price target using a relative P/E ratio and the other 50% using a DCF model.

In our P/E valuation, we forecast KE’s price-to-earnings ratio to expand to its peer group average. Given KE’s small size and opportunity for growth in the automotive, medical, and industrial industries, we believe this multiple expansion is conservative. This relative valuation gives us a price target of $25.27.

In our DCF model, we estimate the firm would earn a return on capital of 10%, reinvesting 20% of this return into its business and growing after tax operations by 5% over the next seven years. We believe these assumptions are conservative given KE’s significant growth opportunities. These assumptions lead to a DCF price target of $25.33.

We then equally blend the relative valuation target, $25.27, and the DCF valuation price target, $25.33, to produce a final target price of $25.30 which we round down to $25.00.

The exhibit below summarizes our peer group multiples.

Singular Research