Considering the fact that your very likely in organization, a Business enterprise specialist, or a Entrepreneur who is researching to find far more information and facts about the that means or distinctions among CAP EX and Servicing Funds Expenses? I have terrific information for you. I am keen to assistance response this query for all you Google Searchers. Today’s lesson will be instantly about a specific line on your Investing functions cash flow statement, Functioning Expenses particulars, and Equilibrium sheets.

So every person if you have not nonetheless taken primary Accounting courses? Your likely like me and studying as you go. It is a ongoing challenge. Nevertheless you have no justification in todays on line data super freeway and access. So in the spirit of sharing awesome new Accounting facts I learn? And for the actuality I uncover myself employing this new know-how in interesting methods. Let us converse about today’s latest matter I uncovered even though investigating what is Intrinsic Benefit in Investing . Which by the way is an completely distinct topic in it is very own ideal. Now on to the principal occasion. Routine maintenance Money Expenditures.

Did you capture my newest short article about “Wealth management Trusts?”

What is this “Maintenance Funds Expenditures or CAP EX”?

You really do not need to have to be an Accountant or enterprise superstar to operate a compact time Lemonade Stand in your neighborhood. So as you start out to sell lemonade? You will likely have cashflow on the equilibrium sheet. This is where by issues develop into exciting.

Today we are speaking about financials? I would appreciate to detail what the line on your Fiscal Statement that say’s Servicing Cash Expenses.

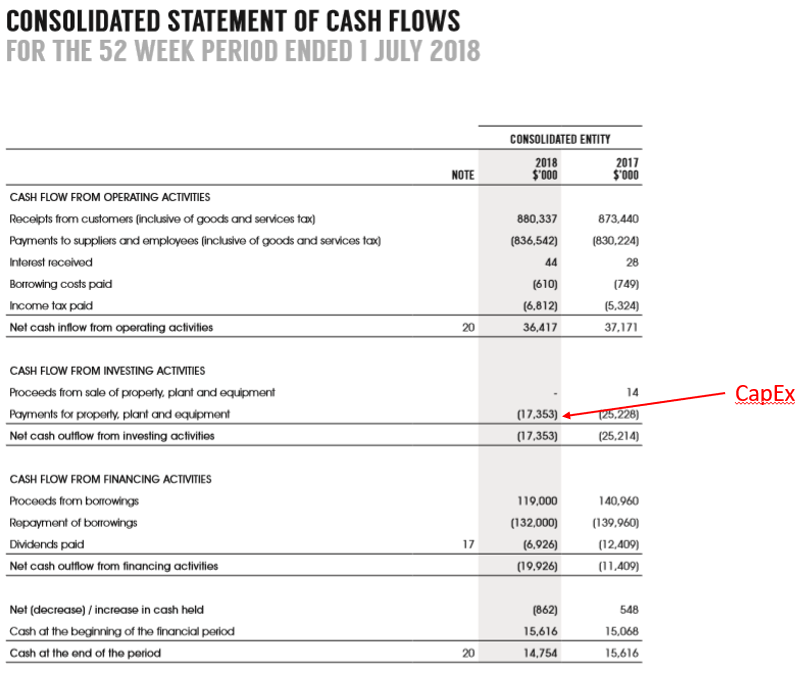

When we search at a company’s income movement statement which you really should know “ENTREPRENEURS!” you will be wanting for the line CAP EX or Maintenance Funds Expenses.

Make sure you never overcomplicate the information here. Having said that when reading through a Funds circulation assertion you will see a line identified as Money Expenditures. It’s the exact exact thing as a Maintenance Capital Expenditure. Cap Expenditures and Servicing Cash Expenditures are the exact issue. Normally periods I do see individuals who confuse CAP EX with Servicing Funds Expenditures. Do not let this confuse you. It is the exact same.

Right here are the two classifications that capital expenses can drop beneath.

When

- Maintenance CapEx: Is the demanded ongoing expenditures of a firm to go on running in its current condition (e.g., mend damaged products, periodic procedure updates) Running Charges.

- Advancement CapEx: Is the discretionary investing of a firm linked to new development strategic programs to receive a lot more customers and raise geographic get to

According to a pal at a community Regional Regulation Agency and as TAX Legal professional and Accountant,

An revenue assertion displays operating fees incurred throughout a period of time.

Capex is regarded a long-phrase investment decision, rather than an running expenditure, for the reason that it has an economic daily life greater than a 12 months (unlike working charges).

In summary in today’s lesson if you are jogging a Lemonade stand in the course of the summer time when teaching your young ones the appropriate way to expenditure a organization? I hope you would now plainly see? That Funds Expenditures and Upkeep Funds Expenses are the exact and they are for all the minor factors the organization requirements to work and create absolutely free money circulation in the easiest of phrases. Remain hungry, keep curious and be fearless when strolling among Captains of Industry.

JS