Britain’s possibilities of a strong restoration immediately after the pandemic have been dented by a substantially additional intense deterioration in company expense around the past six months than in other countries.

Businesses slashed cash investment decision expending in the 2nd quarter of the 12 months, according to formal figures, with much more up-to-day data showing very little recovery in current months.

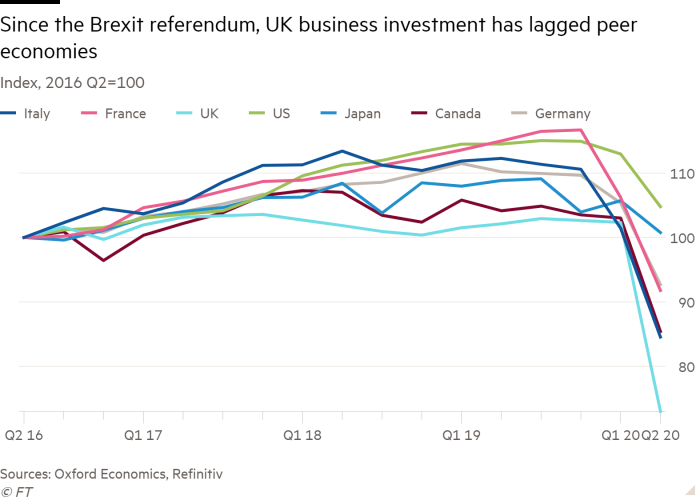

The weak point of small business investment decision, which considering that the 2016 Brexit referendum has underperformed both other economies and preceding documents, bodes sick for the UK’s economic prospective buyers as it restrictions companies’ probably future expansion and productiveness, and as a result employers’ potential to shell out larger wages.

Lingering uncertainty around the UK’s trading connection with the EU after the Brexit transition ends on December 31 is also weighing on businesses’ expenditure strategies.

“Business financial commitment is important for extensive time period advancement,” stated Thomas Pugh, United kingdom economist at Funds Economics, a consultancy. “Businesses which invest far more now will be ready to deliver more in the future . . . and . . . the extra, and far better, devices a worker has the a lot more they can make.”

The latest figures spotlight the crisis of small business financial investment in the British isles economic climate. In the second quarter of 2020, it contracted extra than in any other G7 state, slipping 26.5 per cent, the major quarterly decrease on record.

That slide was far more than twice that for France and Germany and far more than 3 times the US.

By comparison, the worst quarterly contraction through the 2008 global downturn was of 9.6 per cent.

All types of Uk small business financial investment fell, with intellectual assets and expending on successful building and structures contracting at the most significant quarterly tempo on record.

Financial investment in details and interaction machines and in machinery contracted by virtually one-third in the 2nd quarter. Corporations also almost halved investing on transportation products.

In the interval since June, stats advise that while shoppers largely returned to prior shelling out patterns, organizations were significantly more hesitant to devote for the potential when their funds were beneath fantastic strain.

In the hottest Business office for National Data study of companies, taken in the two months to September 6, just about 40 for each cent of corporations documented acquiring decreased or cancelled their expenditure designs all through that period.

More substantial firms, which proportionately undertake most small business financial investment, have slash back tougher than the typical and more than 50 percent of lodging and food items expert services firms surveyed said they had been scaling again their programs.

International financial commitment also dried up, according to information from fDi Industry, a Money Periods-owned company that tracks cross-border greenfield investment decision.

In the 12 months to July, the number of international investment assignments fell by 35 per cent compared to the very same time period in the earlier yr, the major contraction considering that records began in 2003. The drop corresponded to an estimated 11,400 fewer work opportunities developed around that time period, which includes 6,000 fewer positions in small business services.

Now that instances of Covid-19 are growing yet again and the federal government is imposing new community and countrywide limitations on public and small business activity, economists worry that financial investment will keep on to experience a lot more than other elements of the overall economy.

“Uncertainty about the outlook for demand and the danger of a second wave of Covid-19 will guarantee that enterprise financial investment fails to rebound,” said Samuel Tombs, chief British isles economist at consultancy Pantheon Macroeconomics.

Victoria Clarke, economist at the prosperity administration group Investec, additional: “A very reliable bounce again in business investment in Q3 appears to be considerably fewer possible than it does for consumption.”

Element of the worry stems from surveys which counsel managers in British isles companies are extremely cautious about their expenditure designs.

A Financial institution of England study of 2,800 chief money officers from Uk firms instructed that organizations expected their investment decision levels in the spring of 2021 to be 12 for each cent reduce than would have been the scenario devoid of the pandemic.

Brexit has also performed a outstanding part in investment ideas. Ever given that the 2016 EU referendum the British isles has been at the base of the G7 pack for funds expenditure.

British isles enterprise investment was 27 per cent lower in the second quarter of this calendar year than at the time of the referendum: this contrasted with expenditure amounts in the US remaining 5 for each cent increased than 4 yrs formerly, even in the center of the coronavirus crisis.

Many economists and organization leaders worry that the Uk will continue on to lag rivals following calendar year as the financial state navigates the aftermath of the conclude of the Brexit changeover period. Dennis Shen, economist at ScopeRatings, a score agency, stated that even ended up a trade deal to be struck, trade friction would be better and this will drag on investment decision and output progress.

Milton Guerry, president of the Intercontinental Federation of Robotics, mentioned in the federation’s hottest annual evaluation posted last week that the UK had “a surprisingly small robot inventory for a western European country”. He added that, even in advance of the pandemic, Brexit uncertainty “inhibit[ed] the necessary modernisation of producing generation facilities”, which will “determine the speed of economic restoration after the pandemic”.

Are you below 30?

We are discovering the effects of the pandemic on young people today and want to hear from readers among 16 and 30. Notify us about your activities from the past 6 months by using a short study.